Overview of Bitcoin’s Bearish Trend: Why the Market Is Pulling Back and What Comes Next

Over the last few weeks, Bitcoin has entered a clear bearish phase, with multiple technical setups triggering downside targets across nearly every timeframe. Many traders are asking the same questions:

-

Is Bitcoin entering a deeper correction?

-

How much lower can price go?

-

Are we near a bounce—or just getting started?

-

Has the cycle topped?

This detailed breakdown explains the full picture:

the bearish signals, the multi-timeframe setups, upcoming downside targets, why a bounce is still likely, and the key levels Bitcoin needs to hold.

Let’s dive in.

New Bitcoin Targets Revealed!

📉 Daily Price Action Shows Weakness—but Tradable Patterns Remain

Bitcoin’s recent behavior is part of a statistically measurable pattern.

Monday Price Performance Stats

Since the 2023 bull market began:

-

54% of Mondays have closed green

-

Average Monday gain: +2.34%

-

Average Monday loss: –1.89%

This creates short-term scalpable setups:

✔ Upside interest zone: ~$96,000

✔ Downside interest zone: ~$92,500

These Monday statistics don’t produce “home run” trades—but they often produce high-probability scalps when price first touches major levels.

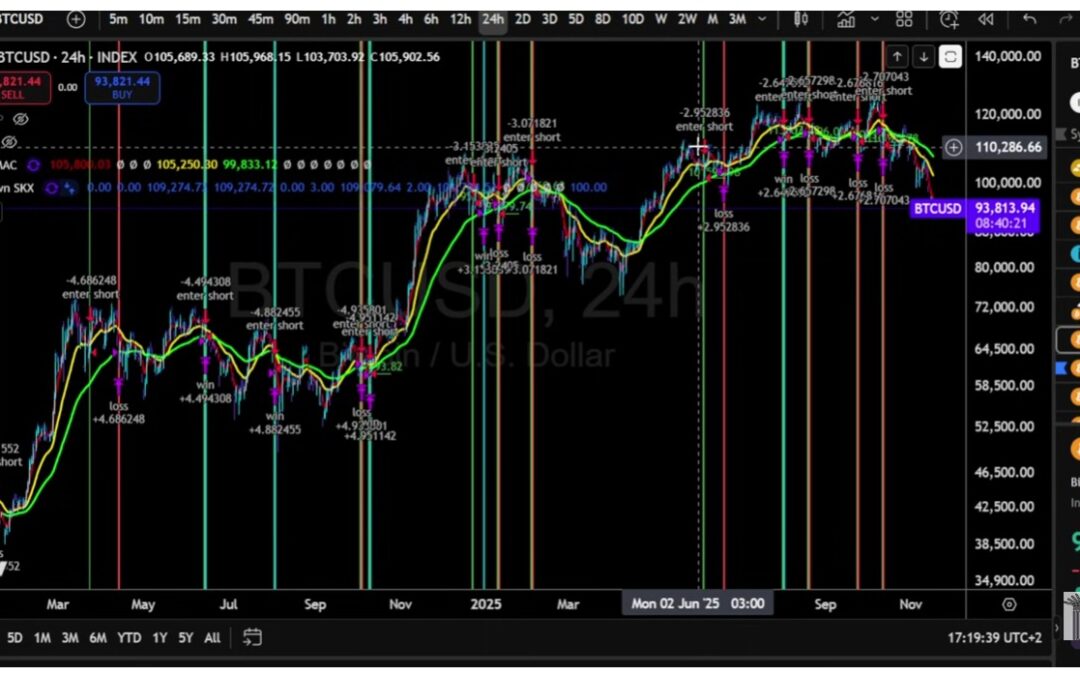

🔻 A Multi-Timeframe Bearish Setup Is Driving This Correction

The main driver of the current downturn is a recurring technical pattern involving two EMAs:

-

4-period EMA (red)

-

21-period EMA (yellow)

Whenever the 4 EMA crosses below the 21 EMA, Bitcoin historically moves to the:

👉 55 EMA (green) as a corrective target.

This setup triggered:

-

On the 12-hour

-

On the daily

-

On the 2-day

-

On the 3-day

-

And most recently, the 5-day

Every single one has hit its downside objective.

This isn’t a trading strategy—it’s directional bias, not a mechanical system.

But its consistency across many timeframes builds a strong bearish narrative.

📉 Higher-Timeframe Charts Point to Lower Targets (8-Day, 10-Day, 12-Day)

Once we move beyond the 5-day chart, reliability decreases—but the signals still matter.

8-Day Timeframe

The 4/21 EMA cross is about to trigger again.

Target:

➡ $88,500 on CME

This level has never failed historically on CME’s limited data—but again, fewer data points means less statistical confidence.

10-Day Timeframe

The next target sits around:

➡ $91,500

This zone is significant because it aligns with:

-

A major CME gap from April

-

A long-standing inefficiency in price

-

The 377 EMA support

Expect a bounce reaction here, even inside a downtrend.

📉 The 12-Day Chart Points Even Lower ($83K–$85K)

The 12-day timeframe has one of the strongest long-term records:

✔ Nearly every 4/21 EMA cross has eventually hit the 55 EMA

✔ Target sits at $83,000–$85,000

✔ This target activates only if Bitcoin closes the week below $98,200

If Bitcoin closes:

-

Above $98,200 → the deeper targets weaken

-

Below $98,200 → the deeper targets strengthen

This weekly close is critical.

📈 Are We Due for a Bounce? Yes—Conditions Are Building

Despite the bearish trend, Bitcoin is setting up for a relief bounce.

Why?

Because of the HPDR (Historical Price Distribution Range) and volatility metrics:

✔ Bitcoin is extremely stretched below its median return

✔ Volatility (BBWP) is extremely high

✔ When volatility peaks and then contracts → price snaps back toward the median

This pattern called the October bounce at $100K and several other moves this cycle.

But: volatility has not started contracting yet.

Do not front-run the bounce.

Once BBWP turns down → high probability of a move back to:

➡ $98K–$101K (retest zone)

Until then, downside continuation is still on the table.

🔎 Bullish Divergence May Be Forming—But It’s Weak

The daily chart could print bullish divergence if:

-

Price makes a lower low

-

RSI makes a higher low

This would support a bounce, but not a full reversal.

Bounce target:

➡ $98,000

→ Maybe $100,000 in an optimistic scenario

Reversal target:

❌ Not in play yet

📉 Stochastic Momentum Remains Bearish

The daily stochastic is deep in the bearish control zone.

It will stay bearish until Bitcoin closes above:

➡ $100,000

Momentum can’t stay pinned down forever—but while it sits here:

👉 Downside is still the dominant trend.

📉 The Trend Is Bearish on Every Timeframe Except the Monthly

This is the most important macro point:

-

12h → down

-

Daily → down

-

3-day → down

-

5-day → down

-

Weekly → down

-

Monthly → still up

The monthly is the last bullish timeframe.

If that flips, the argument for a cycle top gains real weight.

📉 Has the Bitcoin Cycle Topped? It’s Not a Crazy View

The analyst in the transcript admits something important:

“If you think the cycle is over, you’re not out of line.”

This isn’t 2024 anymore.

Many of the classic top signals are here:

-

High-timeframe EMA crosses

-

Bearish divergences

-

Exhaustion signals

-

Failed breakout structure

-

Loss of key moving averages

This is the first time he’s openly acknowledging the possibility that:

👉 The cycle top may be in.

That said, the monthly close will decide it.

💡 Take Profits — Don’t Be Greedy

If you bought Bitcoin at:

-

$20K

-

$25K

-

$30K

-

$40K

You are sitting on life-changing gains.

Whether the bull is over or not:

✔ Taking partial profits is wise

✔ You can always buy back later

✔ You never go broke locking in gains

✔ You reduce emotional pressure

Greed destroys portfolios.

⚠️ A Final Warning About Scams

The transcript ends with a story about a scam involving a hijacked Discord link that drained user wallets.

The key takeaway:

💥 Never click a link in a Discord announcement unless you verify it from multiple official sources.

💥 If it sounds urgent, limited, or time-sensitive — assume it’s a scam.

Scammers prey on FOMO.

Always protect your assets.

🎯 Final Thoughts — A Bearish Trend With a Bounce Ahead

Here is the most accurate summary of Bitcoin’s situation:

-

Trend: Bearish

-

Momentum: Bearish

-

High-timeframe setups: Bearish

-

Bounce probability: High

-

Reversal probability: Low (for now)

-

Key weekly level: $98,200

-

Key bounce target: $98K–$101K

-

Key downside targets:

-

$91.5K

-

$88.5K

-

$83K–$85K

-

Nothing about this is guaranteed.

But based on current signals, the most likely path is:

📉 More downside →

📈 Relief bounce →

📉 Potential deeper correction →

📈 Macro trend reassessment

Trade safely. Manage risk. Take profits.

And never let emotion drive your decisions.

Crypto Rich ($RICH) CA: GfTtq35nXTBkKLrt1o6JtrN5gxxtzCeNqQpAFG7JiBq2

CryptoRich.io is a hub for bold crypto insights, high-conviction altcoin picks, and market-defying trading strategies – built for traders who don’t just ride the wave, but create it. It’s where meme culture meets smart money.